The hacks you should know before investing in a shophouse

When it comes to commercial properties in Singapore, shophouse is the preferred choice for investors, ultra-high net worths and foreigners. The unique architecture of shophouses will enable you to use them for multiple functions, be it a hip cafe on the roadside, an office or a recreation hub lighting up the neighbourhood.

If you are thinking of buying a shophouse, first you need to start with:

- What kind of shophouses do you want to buy?

- Are you eligible to buy your preferred shophouse?

- What will be the purchase cost of the shophouse?

- Lastly, what will be the holding cost of the shophouse?

This segment on shophouses will answer all these questions for you!

- Commercial Shophouse

- Who are eligible to buy a commercial shophouse?

- What will be the purchase cost of a commercial shophouse?

- What will be the holding cost of the commercial shophouse?

- Residential Shophouse with Commercial at 1st Storey

- Who are eligible to buy Residential Shophouse with a Commercial at 1st Storey?

- What will be the purchase cost of a Residential Shophouse with Commercial at 1st Storey?

- What will be the holding cost of a Residential Shophouse with Commercial at 1st Storey?

- Residential and Commercial Shophouse

- Who are eligible to buy Residential and Commercial Shophouses?

- What will be the purchase cost of Residential and Commercial Shophouse?

- What will be the holding cost of Residential and Commercial Shophouse?

Commercial Shophouse

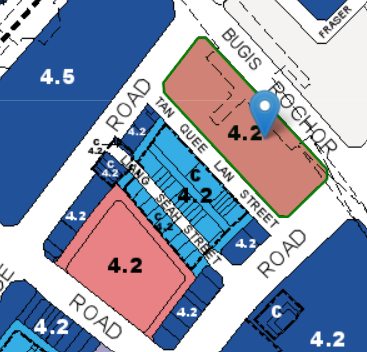

First on our list of discussions is commercial shophouses. Such shophouses are in a fully commercial zone indicated by DARK BLUE in the master plan of Singapore.

Check out the DARK BLUE marked lands in Bugis Street on the map below. The colour of your commercial shophouse zone will be just like this!

All the levels of these shophouses can be used for commercial purposes. However, the portion to be used for commercial usage depends on the relevant authority. Usually, commercial shophouses make an excellent home for food & beverage (F&B) outlets, offices, schools and banks. They also accommodate the following types of usage:

- Mixed uses (Shopping/Cinema/Hotel/Flat)

- Convention/Exhibition Centre

- Commercial School

- Market/Food Centre/Restaurant

- Entertainment

- Foreign Trade Mission/Chancery

- Medical suite

- Clinic

Owners can also build hotels and recreation clubs, subject to evaluation by the competent authority.

Who are eligible to buy a commercial shophouse?

Usually, you have access to most types of real estate if you are a local or permanent resident in Singapore. But foreigners cannot buy landed properties in Singapore. But as a foreigner, you are eligible to buy a commercial shophouse. Thus, these types of shophouses are most in-demand by all target parties be it ultra-high net worths, overseas buyers or affluent investors.

What will be the purchase cost of a commercial shophouse?

Since this type of shophouse is in commercial zones, buyers are not subject to paying the seller’s stamp duty (SSD). Foreigners are also exempted from additional buyer’s stamp duty (ABSD) for commercial shophouses.

However, all buyers purchasing a commercial property in Singapore are subject to buyer’s stamp duty (BSD) up to 3%. This comprises all Singaporeans, permanent residents (PRs), foreigners and entities. Your BSD will be based on the purchase price or market rate of the property, whichever is higher.

Check out the table below to have a glance at how BSD is divided based on the purchase price of your shophouse:

Buyer’s Stamp Duty (BSD)

What will be the holding cost of the commercial shophouse?

Recently, the property tax in Singapore has been revised. It will exponentially increase in the next 2 years. However, the good news is that the tax remains the same for commercial properties. So, if you buy a commercial shophouse, you will only have to pay a flat rate of 10% on the annual value (AV) of your property.

Residential Shophouse with Commercial at 1st Storey

The second preferred shophouse in our list is a shophouse where the first storey is for commercial usage whereas the ground floor is for residential purposes. The master plan allocates these shophouses in a full residential zone with PINK colour for identification.

Check out the PINK marked lands on the map below. The colour of your Residential Shophouse with Commercial at 1st storey zone will be just like this!

For these shophouses, you can make the ground floor your home whereas the 1st storey can be used for commercial purposes. If you wish to convert the entire shophouse for residential use, you will have to ask permission from the relevant authority.

Usually, commercial use for these shophouses is restricted to the 1st floor. But if you want to convert the ground floor for commercial usage instead of the 1st storey, you will have to seek approval from the relevant authority.

The authority will measure the proportion of commercial usage allowed in the 1st storey. You will be allowed the exact same proportion for commercial usage on the ground floor. This is done so that the commercial usage of the shophouse remains exactly the same after the change.

Who are eligible to buy Residential Shophouse with Commercial at 1st Storey?

Singaporeans and permanent residents (PRs) are allowed to buy these types of shophouses. However, since they are in a fully residential zone, foreigners have to seek approval from Land Dealing Unit (LDAU) to acquire them. As a foreigner, if the government approve your application, only then can you buy this type of shophouse.

What will be the purchase cost of a Residential Shophouse with Commercial at 1st Storey?

The buyers for these shophouses will be subject to

- All parties including Singaporeans, permanent residents (PRs) and foreigners will be subject to BSD up to 4% for the residential component of the property and up to 3% for the commercial component of the property.

Refer to the BSD IRAS table above to see the breakdown of BSD according to the purchase price of your property.

- The buyer will also be subject to additional buyer’s stamp duty (ABSD). If you are a Singaporean and a first-time residential buyer, then you will be exempted from ABSD. But for subsequent purchases, you will have to pay between 17% to 25% ABSD depending on the number of residential properties you hold.

If you are a permanent resident (PR), you will be charged between 5% to 30% of ABSD depending on the number of residential properties you own. If you are a foreigner, you have to pay a 30% ABSD regardless of the number of residential properties you own. As for an entity, the ABSD is 35% with an additional 5% for home developers for any residential properties they purchase.

Additional Buyer’s Stamp Duty (ABSD)

| Type of buyer | ABSD after 16 Dec 2021 | |

| Singapore citizens | Buying 1st residential property | No ABSD |

| Buying 2nd residential property | 17% | |

| Buying 3rd and subsequent residential property | 25% | |

| Singapore permanent residents (PRs) | Buying 1st residential property | 5% |

| Buying 2nd residential property | 25% | |

| Buying 3rd and subsequent residential property | 30% | |

| Foreigners | Buying any residential property | 30% |

| Entities | Buying any residential property | 35% + Additional 5% for Housing Developers |

- Buyers will be also subject to the seller’s stamp duty (SSD). If you sell the property within 3 years of purchase, you will be subject to the following SSD based on the purchase price or market price of the property, whichever is higher.

Seller’s Stamp Duty (SSD)

| Holding period(On and after 11 March 2017) | SSD |

| Up to 1 year | 12% |

| More than 1 year and up to 2 years | 8% |

| More than 2 years and up to 3 years | 4% |

| More than 3 years | No SSD payable |

What will be the holding cost of a Residential Shophouse with Commercial at 1st Storey?

Buyers usually buy shophouses for investment purposes. So, they fall into the property tax category of Non-owner occupier category – vacant or rented. As such, if you own these types of shophouses, you will have to pay between 10% to 20% property tax until 2022 based on the annual value (AV) of your shophouse. By 2024, this tax rate will increase to the level of 12% to 36%.

To know more, READ How much property tax increase cost homebuyers and property investors in 2022 vs 2024?

Residential and Commercial Shophouse

You can identify Residential and Commercial Shophouse, otherwise known as mixed shophouses, by the LIGHT BLUE colour in the zoning master plan.

Check out the LIGHT BLUE marked lands in Rocher Street on the map below. The colour of your Residential and Commercial Shophouse zone will be just like this!

This shophouse usually has both commercial and residential usage. However, the commercial portion is not located above the residential portion. As such, the storeys of these shophouses are designed in a way that the commercial spaces, a maximum of 40% of the total shophouse usage area, unless otherwise stated by the authority, are on the ground levels. The residential parts, on the other hand, occupy the top levels.

Unlike a Residential Shophouse with Commercial at 1st Storey, you are not restricted to the commercial usage of Residential and Commercial Shophouse. You can have two storeys put up for commercial use and one for residential or vice versa for mixed shophouses like this. Basically, you can mix it up as long as you don’t use the entire shophouse for residential purposes.

Who are eligible to buy Residential and Commercial Shophouses?

Singaporeans and permanent residents (PRs) are eligible to buy these types of shophouses. As for foreigners, you have to check out the zoning of the property. Usually, the zoning of Residential and Commercial shophouses is temporary. In this case, foreigners do not need to seek any approval to acquire such property. But say the shophouse has 3 storeys and one or all of the storeys have permanent residential zoning. In that case, the foreigner has to seek approval from the land dealing unit (LDAU) due to the residential portion of the property.

What will be the purchase cost of Residential and Commercial Shophouse?

- All parties including Singaporeans, permanent residents (PRs) and foreigners will be subject to BSD up to 4% for the residential portion of the property and up to 3% for the commercial portion of the property.

Refer to the BSD IRAS table above to see the breakdown of BSD according to the purchase price of your property.

- All parties will be subject to ABSD for the residential portion of the shophouse. Singaporeans have to pay the lowest out of the group, ranging between 0%-25% ABSD depending on the number of residential houses they own. PRs may have to pay up to 30% ABSD. Whereas for foreigners, the ABSD is at 30% regardless of how many residential properties they buy.

Refer to the ABSD IRAS table above to see the breakdown of ABSD according to the purchase price of your property.

- All parties will be subject to SSD for the residential portion of the shophouse if the owner sells the shophouse within 3 years of purchase.

Refer to the SSD IRAS table above to see the breakdown of SSD according to the purchase price of your property.

What will be the holding cost of Residential and Commercial Shophouse?

MIxed shophouses are also usually bought for investment purposes. So, they fall into the property tax category of Non-owner occupier category – vacant or rented. As such, you will have to pay between 10% to 20% property tax until 2022 based on the annual value (AV) of the residential part of the shophouse. By 2024, this tax rate will increase to the level of 12% to 36%.

For the commercial part of the shophouse, you will be subject to a flat rate of 10% property tax on the annual value (AV) of the commercial portion of the shophouse.

Now that you know the type of shophouses available in Singapore and who are eligible, you can start your shophouse hunting.

If you like to know the raw and real deals on shophouses, don’t forget to subscribe to our weekly market news update.

Our next shophouse segment will give you full disclosure on shophouse usage and rental yield so you know which shophouse will be the most beneficial for you.