Singapore Property Market Outlook for 2021

We have never imagined we would get to see a year like 2020 in our life. It was unprecedented in its ultimate form. Here, we will be looking backward at how the property market of Singapore performed in 2020.

The events that took so far and what it holds for 2021.

- Looking Back at 2020

- Key Trends to Expect in 2021

- New Projects in 2021

- Is 2021 the Year to Buy or Sell Home?

Looking Back at 2020

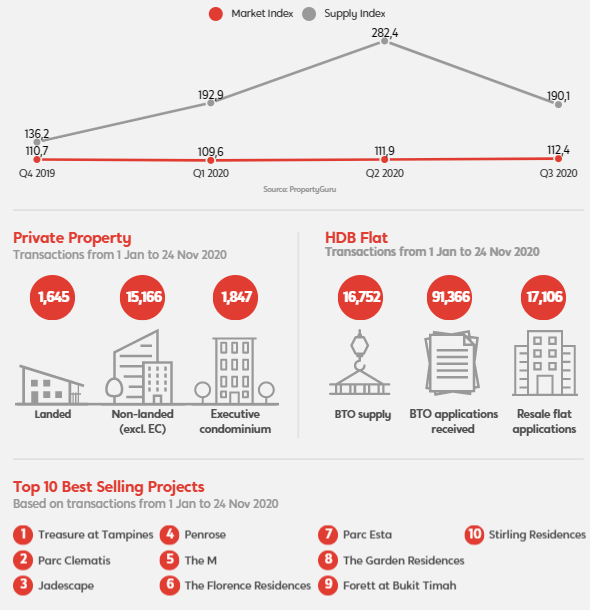

An essential defining event of 2020 was the COVID-19 epidemic. The infamous “circuit breaker” measures affected the property market enormously: show flats were shut, face to face viewings were disallowed and construction works (and thus uncompleted projects) were postponed. April 2020 quickly became the worst performing month to get the business in nearly six years.

Even though industry quickly rebounded in the second half of the calendar year, buyers and sellers stayed wary. Cheap properties in the Rest of Central Region (RCR) and Outdoor Central Region (OCR) and priced between $1,000,000 to $1,500,000 consistently saw the maximum attention and performed the very best.

Mortgage rates also hit record lows after the U.S. Federal Reserve slashed interest rates to near-zero and launched a $700 billion stimulus package in reaction to this pandemic in March 2020. In the third quarter of 2020, the three-month SIBOR (3M SIBOR) fell under 0.5%, as compared to about 2% in the third quarter of 2019.

The current flat-rate rate surroundings can also be quite favourable for buyers in the sector for brand new homes and existing homeowners looking to refinance their mortgage loans.

On the flip side, the private housing glut out of 2019 remains. During the third quarter of 2020, there were 26,483 unsold uncompleted private residential units at the pipeline. This overhang, coupled with the COVID-19 fall out, resulted in the US government cutting on confirmed Government Land Sales (GLS) internet sites in 2020.

Finally, to round off the year, the Controller of Home (COH) announced a new restriction on re-issuing purchase options for the exact unit to the exact buyers. Not surprisingly, there is a small softening in the initial two weeks of October, but developer sales began to grab briskly in November.

Singapore Property Key Trends to Expect in 2021

COVID-19 has triggered a shift in property buying habits, and we all expect these trends to persist as the state adopts the “new normal”. Buyers are likely to remain price-sensitive and open to larger homes in suburban districts which tend to be somewhat more valuable.

A similar tendency was observed this season when HDB resale prices rose by 1.5% quarter-on-quarter (QoQ) in Q3 2020.

The purchasing market will last to be dominated by sailors, that made up over 80% of the land purchasers this year. While this category is composed chiefly of genuine, owner-occupiers, the requirement is likely to stay resilient.

Needless to say, the seasoned foreign investors will continue to invest from the prime districts. This will be on account of the world’s sound principles, policy ethics, safety and political equilibrium. There’s absolutely nothing in their way of buying Singapore real estate. Some cooling measures such as Additional Buyer’s Stamp Duty (ABSD) will be there. They will also require consent should they want to purchase any landed properties. But those restrictions were already in place before this COVID-19 pandemic.

With the federal government cutting on land distribution, developers can take 2021 to reevaluate past failed en-bloc sale websites. It would also help them to resurrect their property banks. Hence, we may see an en bloc season next year.

On the house financing, the Federal Reserve has announced interest rates near zero, at least until 2023. Therefore, we expect Singapore mortgage rates. This can be closely associated with rates that are fed, to similarly stay low until afterwards.

New Singapore Property Projects in 2021

Some developments which were originally planned for this year were eventually postponed to 2021. But the number of new releases in 2021 remains fewer than in 2020. Here is a review of the new endeavours expected next year.

Is 2021 the Year to Buy or Sell Singapore Property?

Singapore property makes 2021 an important year for investors. The elevated sentiments of property buyers suggest more buyers are inclined to buy. The improved market and wider demand make 2021 a promising year.

Housing demand is very likely to remain resilient in 2021, but prices are likely to remain stable. Even when supported by strong demands, in the opinion of economic doubts, sellers and programmers will have a sensible approach.

Of course, what lies ahead is highly determined by the international COVID-19 situation. Just how much we recuperate in the outbreak, but based on the business’s performance in 2020, the signs appear encouraging.

Read more about my forte and service here.