How to secure assets & generate profit in periods of stagflation?

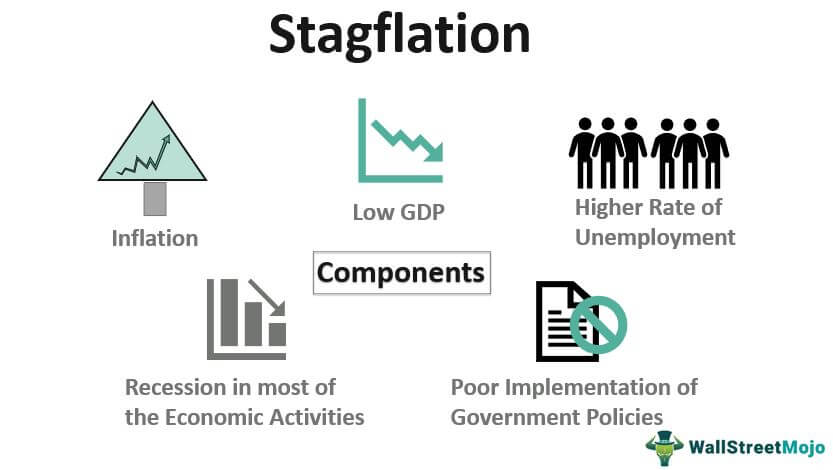

Stagflation occurs when the inflation rate hikes up, the economy slows down and the unemployment rate increases. The soaring global inflation has been making news since the start of 2022. With the new development of the Russia-Ukraine war and China’s worse pandemic flare since 2020, is stagflation coming or is it just a fluke to petrify the already distressed buyer’s sentiment?

- THEN vs NOW

- How to secure your assets in stagflation?

- Is it the best time to invest in properties?

- More insight on diversifying your assets in critical times.

The phenomenon of stagflation occurred in 1974. That was the first and only time it ever happened. Before concluding the worst, I have pulled data to compare the similarities between THEN vs NOW.

THEN VS NOW

| THEN (1974) | NOW (2022) |

| During the Arab-Israel war in 1973, the Organisation of Petroleum Exporting Countries (OPEC) temporarily ceased oil shipments from the Middle East to the US and other countries to support Israel. | In 2022, the US put an embargo on oil shipments due to the Ukraine-Russia war. Many countries followed suit to show their support for Ukraine. |

| This led crude oil to shoot up from $26.82 to $61.83 per barrel, a 130.54% increase from 1973 to 1974. | Similar to 1974, the war caused crude oil to spike up. It increased from $75.21 to $102.02 per barrel, a 35.65% increase from 2021 to 2022. |

| The port congestion and shipment delays due to the Arab-Israel war-induced embargoes caused supply chain disruption. | Currently, China is seeing the worst cases of Covid since 2020. Singapore is feeling the heat as shipments from China are delayed. Besides, the sanctions and embargoes due to the Russia-Ukraine war is adding to the supply chain disruption as Singapore is a trade-dependent economy. |

| The dramatic rise in oil prices choked the economic growth of Singapore. The country’s Gross Domestic Product (GDP) dropped from 10.60% to 6.12%, a 4.49% decline from 1973 to 1974. | Singapore’s economic growth is at a chokehold. In 2021, the country’s GDP growth was 7.6%, which has now come down to 3.4%. |

| The consumer price index (CPI) pushed up from 33.71 to 41.25. This was a 22.37% rise from 1973 to 1974. | Singapore’s CPI rose to an all-time high of 106.69 as of March 2022. It increased by 4.48% from the previous year. |

| The higher price of food and service led to inflationary pressure. As a result, Singapore’s inflation reached 22.37% in 1974, an all-time high in the country’s history. | the country’s inflation hit a decade high of 5.4% in March 2022. |

The common denominator between 1970 and 2022 is raging war, rising inflation and a struggling global economy. The unemployment rate is also high due to the pandemic.

All this warrants a stagnant economy meeting high inflation.

But we are not there yet!

Comparing the situation between 1974 and 2022, you can see that conditions were much worse THEN compared to NOW. Besides, the Singapore government is already putting measures in place to balance inflation without costing the economy.

But if worse comes to worst and stagflation indeed arrives, you need to secure your money. You need to invest in a safe harbour and position your assets such that you don’t lose the wealth you have grown over the years.

How to secure your assets in stagflation?

Perform due diligence on your portfolios in times of stagflation to stay ahead of the curve. Invest in diversified assets to maintain your asset’s growth. The best instrument to invest is in something which has a stable return that won’t be significantly affected by the stagflation.

The housing market, for instance, is not affected by inflation the way other consumer goods are. In Singapore, whenever the property prices escalate too high, the government imposes cooling measures to keep the property prices stable. As for rental, the inflation will affect it but it can be a positive thing for owners. They can enjoy high rental yields with the growing inflation.

Is it the best time to invest in properties?

As investors, you have to eye the best opportunity to make your move. Stagflation will put many countries into recession. This will lower the purchasing power of people. Not many people will have a large amount of money to buy properties.

The market will have less competition. You will have more opportunities to negotiate the best price from developers as they will want to sell their properties. You may even get discounts and offers from sellers as they will want to sell the property to avoid an overhang situation.

However, you have to be cautious while buying the properties. I recommend you choose a location that is secure, law-abiding and in a good form.

Singapore has time and again shown that it can manage a stable economy even during a pandemic crisis or recession. Many foreign investors also find the place a safe harbour to secure their wealth. A strong economy translates to a strong currency which will further support your investment growth.

READ Why more and more foreign buyers purchasing shophouses in Singapore?

Besides, the Russia-Ukraine war will not persist too long. There are already talks of sorting things out peacefully. This will help the global economy to revive from the oil shock.

China is also putting all hands on deck to curb Covid cases. The current situation is only a temporary hiccup. So, the global supply chain will also kick back to its usual form.

Basically, you will be able to buy a good property at the best price that will generate impressive cash flow. In future, when this temporary crisis settles, you can even sell the property at an excellent profit margin.